Veribest ISD

BOND 2022

BOND 2022

| Home Value* | Annual Amount | Monthly Amount |

|---|---|---|

| $100,000 | $141.90 | $11.85 |

| $150,000 | $260.15 | $21.73 |

| $200,000 | $378.40 | $31.60 |

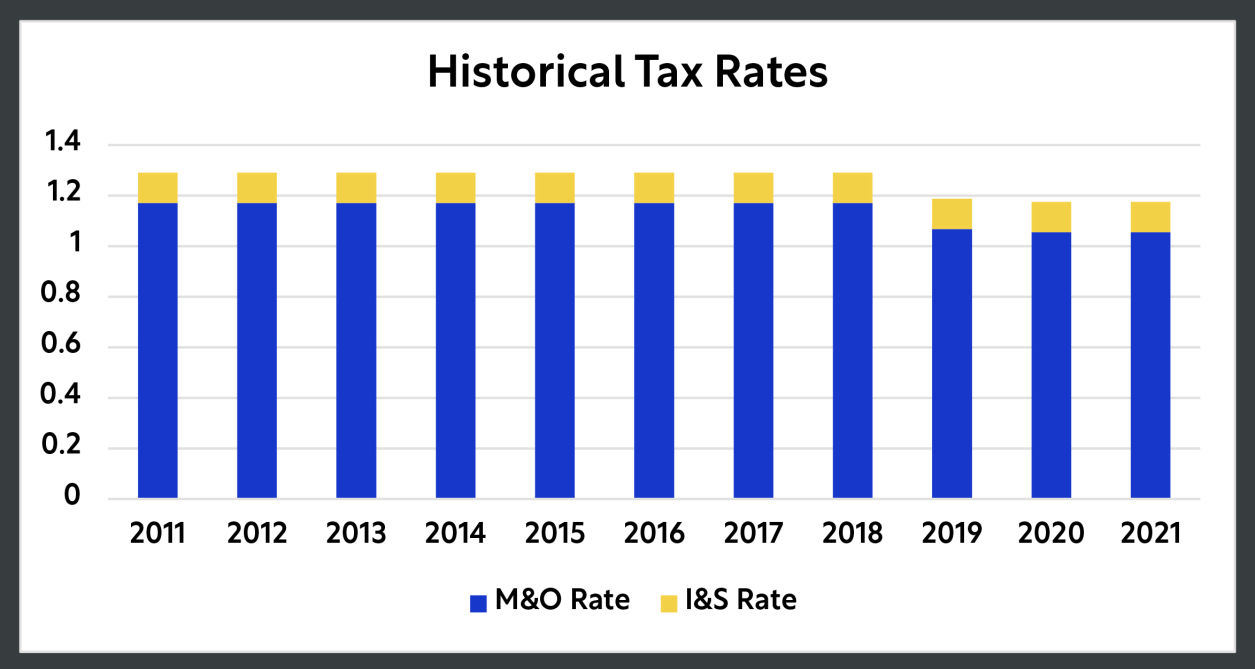

| Year | M&O Rate | I&S Rate | Total |

|---|---|---|---|

| 2022 (before bond) | 1.055 | 0.12 | 1.175 |

| 2023 (after bond) | 1.055 | .3565* | 1.412* |